What are Paystubs and Their Importance

As an employee, you may be aware of why you should be keeping your paystubs, or you may not know their importance. If you have not worked previously or have been out of work for a period of time, you may have forgotten how necessary it is to keep track of every one of your paystubs.

We have spoken to various employees who had no idea why they had to keep their paystubs or even how to read them accurately. So, we are here to give you some information about what your paystub includes and why you need to keep them.

Table of Contents

What is a Paystub for Employees

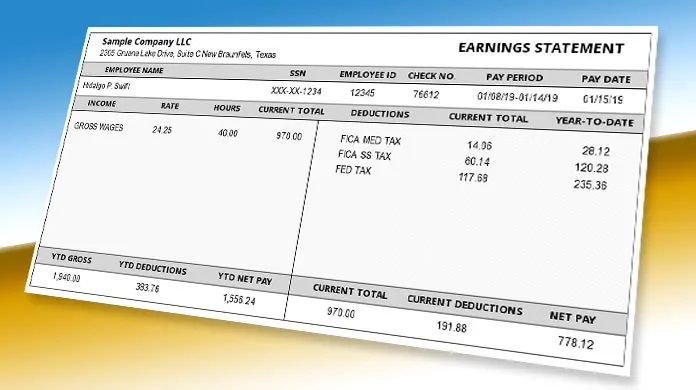

A paystub is your record of all of the payments you have received from your employer. This is your way of keeping track of the payments and any deductions made by your employer. This will provide you with all of the information regarding your employment income that is needed to file your tax returns.

You can see the full details of your pay, state and federal tax deductions, and any insurance or student loan deductions that have been withheld from your net pay. Keeping your paystubs will ensure that you have a full record to complete your tax return each year to ensure that the deductions made are correct.

You will also have a record of any other monies withheld, which you can monitor and ensure that you have been paid the correct amount. So, it is important that you know how to read your paystubs; otherwise, you will not know if the correct deductions have been made. If you need help with how to read a paystub, you should research this after receiving the first payment from your employer.

When looking up how to read a paystub, you should check this for the state you work in, as the information required to be included on a paystub can differ depending on the state.

Why You Should Keep Your Paystubs

It is important that you keep your paystubs for numerous reasons. The length of time you keep your paystub is up to you. However, the recommended minimum duration is one year or until you have filed and had your taxes accepted. As you will need your paystubs for your taxes, it is sensible to keep them until that has been filed.

You may also need your paystubs as proof of income for financial applications, housing, or school fees. The number of paystubs required for proof of income will depend on the application that you are making. This is why the recommendation of keeping paystubs for a year is the option we choose to follow.

As you get paid each pay period, you can safely discard one of last year’s paystubs, ensuring that you destroy it thoroughly so that others cannot read your details. The easiest way to do this is to file your paystubs in date order of receipt so that the oldest can be removed as the newest one is filed.

Benefits of Paystubs

To Keep an Accurate Record of Payments

Generating payroll records is a necessity for all businesses operating in today’s market. Having pay stubs readily available can have many positive impacts on a business’s organizational structure and overall success.

The first reason is that pay stubs provide an accurate and comprehensive record of payments to each employee, making it easy to review hours worked, wages paid, deductions taken, and any additional benefits or allowances they may have earned. This helps ensure that employees are treated fairly and equitably within the workplace. Additionally, having this information easily accessible makes it much easier for businesses to manage their finances accurately and quickly respond to any discrepancies or disputes that may arise from payroll issues.

Easy Tax Season

Tax season is a time of significant stress and anxiety for many people. It can be hard to stay organized and on top of all the paperwork, tax forms, and deadlines that accompany filing taxes. Fortunately, there are a few steps one can take to make the process much smoother. Pay stubs are an invaluable resource at tax time; they provide key information about your income and deductions, making filing your taxes easier.

Having easy access to accurate pay stubs allows you to know exactly how much money you made during the year, which is essential when preparing your return. You can also get an idea of any potential deductions that may apply so you don’t miss out on any savings opportunities.

Additionally, pay stubs can help verify expenses like charitable donations or student loan interest payments; this helps ensure you receive any applicable credits or refunds quickly.

Ensures Transparency

Pay stubs are an invaluable tool for both employers and employees. By providing a clear, accurate record of employee earnings, pay stubs make it easier to understand what money is owed to employees and help ensure that no discrepancies can occur. For businesses, pay stubs provide transparency into their hiring practices and the wages they’re paying their workers; this allows them to keep track of employee hours and create a more efficient payroll system.

For employees, pay stubs are an essential means of understanding their earnings in real-time; they give workers peace of mind that they’re being paid accurately for the work they do. Pay stubs also provide essential information about taxes withheld from each paycheck which helps employees plan out their financial decisions better.

Ensures the Growth of Business

Pay stubs are essential to any business, but they’re not just reserved for established small businesses. Providing pay stubs to employees is especially important for start-up businesses looking to establish themselves as legitimate entities in their industry. Not only does it demonstrate that the business takes its commitments seriously, but it’s also a smart way to avoid potential legal issues down the road related to payment accuracy or withholding taxes for employees who don’t have access to banking systems or other financial services.

Conclusion

Paystubs are invaluable documents that provide an essential record of employee income. Whether you are saving paystubs to track your own income or using them to verify the wages of an employee, understanding the information they contain helps ensure accuracy and compliance. Paystubs provide a glimpse into our financial lives and serve as an important reminder of what we have earned over time. With the right approach and the correct information, paystubs can be used to secure past and future finances with ease.